The Of Paul B Insurance

Wiki Article

The Single Strategy To Use For Paul B Insurance

Some individual agreements that you have with clients might require insurance policy in case something goes incorrect. Without insurance policy, your small organization (as well as, truthfully, you) are going to be paying for that staff member's Employees' Payment out of pocket.

If your business is not insured and also a natural disaster happens, your business may be literally destroyed without any monetary backup for repair services or replacements. No matter what sort of all-natural calamity it could be, residential property insurance is what you need. This is a really important kind of insurance coverage for any kind of company to have, however specifically small services that don't have the resources to totally change points if they get unexpectedly ruined.

Without responsibility insurance, you could fail promptly if you are sued or have a legal action on your hands. This is true even if you win the situation since legal charges can be very pricey. Whether you are filed a claim against by an ex-employee or due to the fact that of an agreement gone wrong, being taken legal action against can cost you a great deal of money and it's all going to come straight from your business.

With all of the kinds of insurance coverage choices available, how can you pick the ones that are going to be useful? A lot of small companies require at the very least a couple of insurance policy strategies. These will include: As long as you have the standard insurance policy needs to cover most aspects of what may happen, you need to feel confident that your business is secure.

Paul B Insurance for Beginners

Since you recognize the significance of insurance, you might really feel inspired to pick a strategy and get it for your business. At Plan, Dessert, we are proud to be able to provide a less complex way to buy business insurance coverage. You can have selections in your coverage and also exactly how you get or keep it.

As soon as you're all set, you can begin to obtain a quote online and begin the course towards a safeguarded tomorrow!.

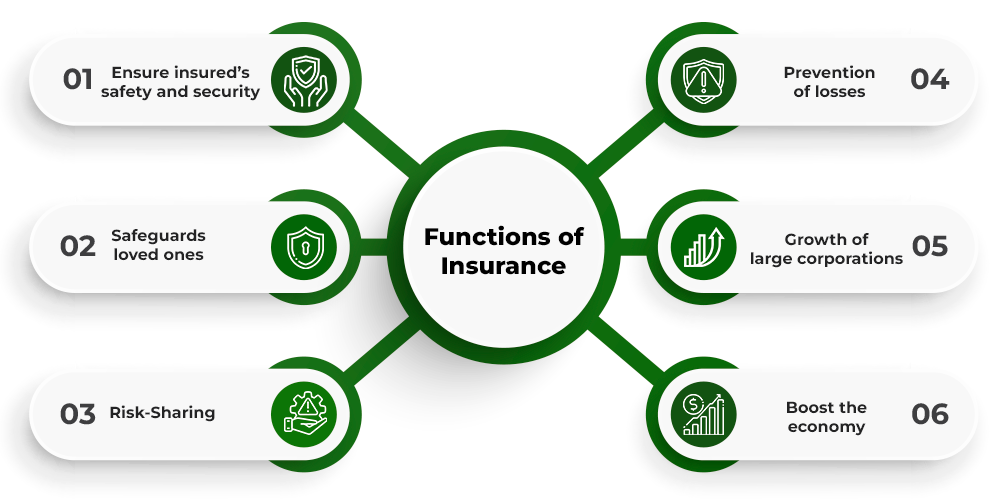

The function of insurance is to guard against financial loss by having the "losses of the couple of" paid by "payments of the lots of" that are subjected to the very same danger - Paul B Insurance. Insurance provider invest exceptional dollars gathered every year in a variety of financial investments. Consequently, it is simple to see how the insurance policy industry plays a vital role in our country's economy.

The term "if you wish to succeed, you have to start near the bottom" enters your mind. We'll take a look at the very standard role insurance coverage plays in our lives and also in the lives of our loved ones. What function does it offer, as well as what purpose can it be developed to offer? Truth value of insurance coverage hinges on its capability to shield human life values.

Paul B Insurance for Beginners

Annuities, on the other hand, can be developed to offer a stream of income for the annuitant's life time or for a specific amount of time, relying on the sort of annuity bought.

Danger Management is the technique of examining a business's or a person's dangers and also then mitigating the prices connected with such risks. There are 2 kinds of threats in each circumstance.

special info

The 2nd kind is the expense related to decreasing or getting rid of the opportunity of feasible failing. The expense of purchasing cover against fire damages or the price of not creating the plant in any way will certainly be included here. For Risk Monitoring to be reputable, these 2 kinds of costs have to be stabilized versus the other.

Depending on the circumstances and also sort of Danger, one can choose the best means to manage Danger. 1 (Paul B Insurance). Playing it safe 2. Lowering Dangers 3. Transferring of Threats 4. Retention of Dangers The very best means to prevent a potential loss from a certain procedure is to avoid it entirely. The choice not to start a shop due to the Threat of losses.

10 Simple Techniques For Paul B Insurance

In this situation, you are moving the Risk to somebody else in this scenario. It is mostly appropriate to economic threats as well as instances where it is possible to write it into agreements. A simple example is insuring on your own versus the possibility of burningthe insured bears the monetary Danger if a fire problems your warehouse. Paul B Insurance.

You should, nevertheless, make a calculated and educated decision to think about the opportunity. It would certainly aid if you really did not pick that by default because you haven't provided the other options much assumed This method is better for minor dangers with a reduced effect or for threats that are difficult to happen, such as the opportunity of a meteor striking your head office.

original siteWhat duty does Insurance policy play in danger monitoring, as well as what is its significance? Insurance has actually established as a means of protecting individuals's possessions from loss and complication.

The plan may be made use of as collateral to safeguard a car loan for the firm. As a result, Insurance will certainly assist the firm in acquiring added credit score.

How Paul B Insurance can Save You Time, Stress, and Money.

In easy words, insurance policy is a threat transfer system, where you transfer your danger to the insurance policy firm and also obtain the cover for financial loss that you may encounter due to unanticipated occasions. And the amount that you pay for this plan is called costs. There is insurance coverage readily available for numerous risks, beginning with your life to cellphones that you use.

In instance you do not make a case throughout the specified plan duration, no benefits will certainly be paid to you. Nonetheless, there are numerous kinds of products provided by insurance business today which likewise involve cost savings component affixed to it. Deductible refers to the quantity of the claim that is sustained by the insurance policy holder.

try this out

Deductibles play a crucial role in choosing the practicality of your future claims. So, it is important to pay utmost heed when determining the deductibles for your insurance coverage strategy. Insurance coverage are the much-needed support column one calls for at the time of requirement. The prominent functions of insurance coverage are among the functions of an insurance coverage is its ease of purchase.

Most insurer supply the choice of both online as well as offline purchases of the plans so people can choose as per their convenience. The fundamental purpose of an insurance coverage is to offer financial aid when in demand. Be it health and wellness, car, or any type of other insurance plan, the objective is to extend the financial aid.

Report this wiki page